That's it, folks, the awaited announcement of this morning has been done and DLP announced a proposal for a €1 billion recapitalization of the company. NO new rides or attractions, shows, etc... were announced and this will be done probably later this year as the purpose of this morning meeting was strictly financial. I will come back soon on D&M on what all of this means but for now, find below the official statement as well as video in which Mark Stead, DLP CFO explain what was announced this morning. As a DLP fan, if you don't understand well what all of this mean, in two words, DLP will have plenty of money up to 2024 to build new rides and do the awaited platemakings that we're all waiting for.

Edited: A bit more about all this: "The plan aims at improving the cash position of the first tourist site in Europe of approximately 250 million and significantly reduce its debt, bringing it under one billion euros (1.7 billion against present). "Disneyland Paris is the number one tourist destination in Europe, but the deterioration of the economic environment and the debt burden of the group have strongly impacted revenues and liquidity," said Tom Wolber, the new president of Euro Disney who took office in mid-September. "This proposal to recapitalize Euro Disney is essential to strengthen its financial position and allow the group to continue to invest in the park to improve visitor experience," said he said.

In detail, the recapitalization provides a cash contribution of approximately € 420 million, "made or guaranteed by Disney through capital increase of Euro Disney SCA and its principal operating subsidiary," according to a statement . It also provides for "the conversion, for an amount of € 600 million, a portion of the debt held by Disney as part of capital increase of Euro Disney SCA and its principal operating subsidiary."

The plan will also result in the postponement of the repayment of loans made by Disney, and the consolidation of existing lines of credit with Disney in a unique revolving credit facility of an amount of € 350 million coming maturity in 2023.

The company said that due to regulations, Disney would ultimately "obliged" to launch a public tender offer (OPA) on Euro Disney shares, which could lead to a withdrawal of business of the Paris Stock Market."

After the official statement below, more explanations about all this so keep scrolling down!

Euro Disney S.C.A. announces a proposal for a €1 billion recapitalization

Overall rationale

The proposal is designed to improve the financial position of Euro Disney and enable it to continue investing in the guest experience.

Context of the operation

Challenging economic conditions in Europe coupled with Euro Disney’s debt burden have negatively impacted its financial performance. Due to these factors, Euro Disney has been constrained in its ability to make investments in Disneyland Paris

Details of the proposal

Cash infusion of approximately 420 million euros, made or guaranteed by Disney through capital increases of Euro Disney S.C.A. and of its principal operating subsidiary;

Conversion of 600 million euros of part of the debt owed to Disney into equity of Euro Disney S.C.A. and of its principal operating subsidiary;

Deferral of all amortization payments of loans granted by Disney until revised maturity in 2024 (currently 2028); and

Consolidation of the existing lines of credit granted by Disney maturing in 2014 (which has been already extended by Disney to 2015), 2017 and 2018 into a single 350 million euros revolving credit facility maturing in 2023

Objectives of the proposal

Improve the cash position of the Euro Disney Group by approximately 250 million euros;

Reduce the Euro Disney Group’s indebtedness, currently exclusively owed to Disney, from 1,748 million euros to 998 million euros, reducing its net leverage ratio from approximately 15x to 6x;

Improve the Euro Disney Group’s liquidity through interest savings and deferral of amortization of loans until final repayment in 2024.

Parties involved

Euro Disney S.C.A. shareholders would have an opportunity to participate in the capital increases of Euro Disney S.C.A. alongside with Disney, at the same price.

As a result of the contemplated capital increases of Euro Disney S.C.A. and in accordance with applicable regulations, Disney would be required to launch a tender offer on Euro Disney S.C.A. shares.

Euro Disney S.C.A.’s Supervisory Board has expressed unanimous support for this proposal.

Indicative Timing of the operation and milestones

After the information and consultation of the Workers’ Council and the Shareholders’ approval during the general meeting of ED S.C.A.’s shareholders early 2015, the transactions contemplated by the proposal are expected to be completed in the first semester of calendar 2015.

Now, a bit more of explanations coming from ED92. I remind you that ED92 is the one who announced months ago what is happening today and one of my previous post on April 22 HERE told you all about what they said at that time. ED92 was attacked by many saying that it was all wrong, but not on D&M where i had from the start the feeling that it sounds right. So, let's pay a well deserved tribute to them with this translation of their explanation of todays announcement as they do it better than i could do it myself. And they do it with humor, presenting the plan as if it was a Gusteau menu!

"The Extraordinary Works Council of Euro Disney SCA has met. Once everybody installed chief Remy comes in and presents the Menu of the Day which is a variant of its new Premium Menu served recently at the Chez Remy Bistrot at the Walt Disney Studios: "The Gusteau Menu":

- Appetizer: Deferral of Debt to 2024 and renewal of the credit line

- Entremet

- Main Dish: Converting almost 50% of the debt for shares (or approximately 600 million Euros)

- Dessert: Direct Capital Increase of 420 million.

Appetizer: "Report of the debt repayment until 2024"

TWDC has become September 27, 2012 the only Euro Disney SCA creditor. Debt at September 30, 2014 was: 1 748 million with an interest rate of 4%.

Eurodisney SCA will only pay the interest on the loan and will not repay the debt in itself, its full refund will have to be done in December 2024

The credit line of 100 million granted by TWDC, due in 2014 (the latter having been extended to 2015 ) is converted into a single revolving line of credit of an amount of EUR 350 million ending in 2023 .

Entremet: Introduction

Why an ExtraordinaryWorks Session?

Any modification, reduction or increase of the Share Capital of Euro Disney SCA is subject in France to strict regulatory conditions. In the case of Euro Disney SCA it is be subject to the formal approval of the representatives of the Works Council, met in a special session.

A change in the share capital is also subject to conditions of time and information to shareholders.

Increase in Share Capital of a company?

The increase in the social capital of a company is to increase the social capital of the latter, by creating new shares purchased by shareholders, old and new, if necessary through the use of financial markets, or by incorporating into the Social capital portion of the profits that had been set aside. This has never been the case for Eurodisney SAS.

Main Dish: Conversion of a part of the debt in shares (~ 600 M €)

This is an operation affecting the rights of capital providers, here TWDC, which converts Euro Disney SCA debt in shares.

In two words, TWDC converts 600 million Euros of Euro Disney SCA debt in share.

Result: Euro Disney SCA has now a debt of "only" 998 million euros, and TWDC gets for 600 million Euros in Shares of Euro Disney SCA.

Dessert: Direct Capital Increase of € 420 million

Euro Disney SCA wants to raise 420 million Euros to bring extra cash in its account immediately.

So it applies the principle of preferential priority called 'Preferential Subscription Right' for a maximum amount of € 351 million.

Each shareholder of Euro Disney SCA has the right to purchase a number of shares determined in proportion of the number of shares he had before the transaction date.

This right cannot be reduced: so it's called 'subscription rights to irreducible title". It allows the shareholder to maintain its proportion of capital held in Eurodisney SAS, and it will be of 9 new shares for one old share held.

You must also know that the subscription right is not attached to shares already held, and can be sold to a new investor wishing to acquire shares. Shareholders are not required to subscribe for new shares to which they are entitled. They can also simply abandon their right.

In our case, according to the release, the Capital increase of Euro Disney SCA will be at a preferential rate set at 1.25 euro per share. More details remain to be be clarified in the coming days, we expect the release of Euro Disney SCA about it in a few days.

Once the 351 million Euros together, new shareholders will be asked to buy at the minimum reserve price of 1.25 euros per share, until we arrive to the wanted 420 million Euros. The final share price will only be known when Euro Disney SCA will file its offer on the stock markets.

The meal is finished, Rémy advances feverishly and presents the bill to the member works extraordinary committee.The impact on DLP treasury will be to provide 1 billion euros by 2024.

The ghost of Gusteau approaches Remy and asked, "But what will we do with all that money?" Remy answered, "I reserve this for a next surprise feast".

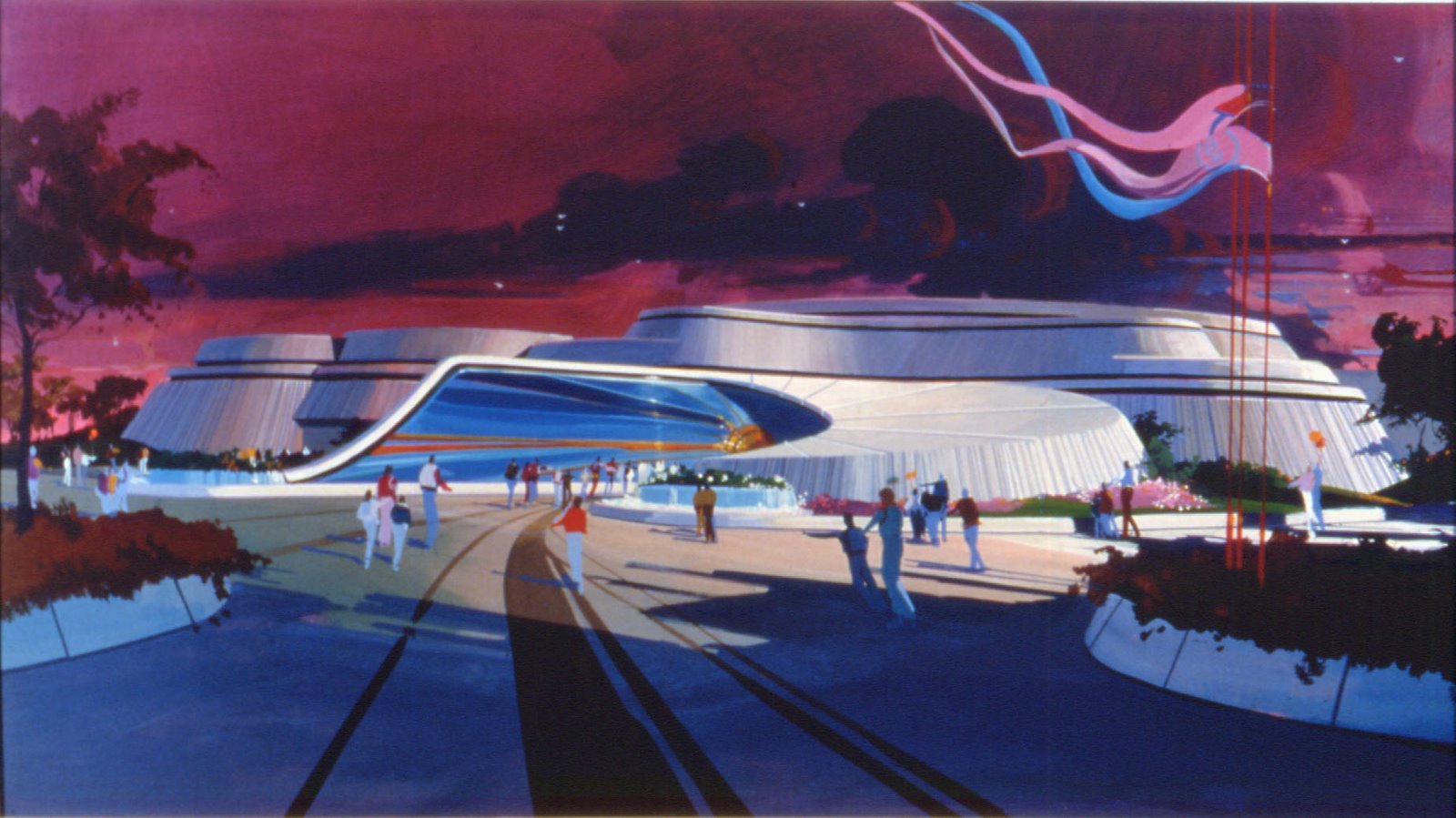

And now, here is my take about all this: First, it's good news for all DLP fans, as it mean that DLP will have the funds to create new rides in the coming years, including the awaited WDS placemaking you're all waiting for. The announcement has yet to be done, but it will come, and if you want to know what will be on the menu i suggest that you go back and read my April 22 post in which was related what ED92 was announcing for DLP future. So far, they've been right in what they announced so i think we can give them the benefit of the doubt on the rest of their announcement. And since their April post, ED92 also posted a sequel last month in which they announce the latest development projects that DLP has currently in mind. You can read it on the ED92 forum HERE, please note that you'll need to register and that the text is written in french and like a "fairy tale", although the infos are very clear. But before you do the jump, here is one more thing and an important one as there is something else probably hidden behind this announcement.

As you may know the WDC although having almost 40% of Eurodisney SCA shares is still a minority shareholder ( Prince Al Waleed owns 10% and the others 50% are own by small shareholders ). Euro Disney said this morning that due to regulations, the WDC would ultimately "be obliged to initiate a takeover bid" ( an OPA in french ) on Euro Disney shares, leading the WDC to become most probably a stockholder which will have the majority of the shares, in other words, to have legally the total control of Euro Disney.

Think about it, since years the WDC had to came to DLP rescue and to give huge amount of money - billions, in fact - and all this without being "legally" in control of the company. Due to the current financial situation DLP needed help once again from the WDC, hundred of millions of euros, and the WDC probably thought that enough was enough and what was asked could only happen if their status of minority shareholder would change. But, probably for legal reasons and due to the original structure of Euro Disney SCA it was not possible to change it directly. Unless this kind of recapitalization allows them to launch a takeover bid... and to become legally the majority shareholder and owner of Euro Disney SCA.

That's probably the hidden goal, and this plan could also eventually lead to a withdrawal of Euro Disney from Paris stock market. "It's a possibility but it is not no intention nor the purpose of the operation. It is in the hands of shareholders, "said Mark Stead DLP CFO, adding that shareholders will be able to participate in the capital increase. Sure, Mark, each shareholder will be able to participate in the capital increase, and specially those from the other side of the Atlantic.

Picture: copyright Disney

5 comments:

Hopefully this will mean that the park will be able to invest in much needed refurbishments and a new E-Ticket attraction for the main park and further build upon the Studios.

Hmm. Pushing off debt again. Feels like old times at DLP. Doesn't the Prince being a major shareholder need to sign off on this?

I hate to bring this up as I'm sure it's not going to be a popular idea. But since they have a surplus of hotel rooms perhaps turning one of them into a DVC may help. As much as I and many others hate them it's been a great cash flow for WDW.

Finally WDC can take over this park and give it what is needs. Great story!

Dlrp is not a bad resort. look at hkdl I think its worse there. Dlrp could be much better yes and I think they have already been trying to do this but this financial help can support this resort in a very good way.

That's excellent news!

I really hope that TWDC will take over Euro Disney and manage it, so that the Resort can, first of all, have the same level of maintenance and upkeep of its American siblings and, after this, do the much needed placemaking of DSP, update current DLP attractions and add new E-Tickets to the first gate.

I love DLRP, I think that it has a lot of potential and that the first park is undoubtedly the most beautiful MK, but guest experience has been deteriorating over the years as the first park is getting old, the second cannot find a permanent solution and the upkeep of the Resort is worsening and becoming an embarrassment to the WDC.

It was about time for them to do something!

By the way, I don't think that they can turn existing rooms into DVC rooms, because DVC rooms must have a small kitchen, a living room... maybe they could convert some rooms into DVC studios, but the Villas would probably have to be built from scratch and, being a DVC member I would love to have units in Paris, but I don't know if the European public would buy them.

Post a Comment