Bloomberg reveal in its today's article HERE that Disney is close to winning U.S. antitrust approval for its $71 billion deal for 21st Century Fox, creating a potentially insurmountable hurdle for a rival bid from Comcast. Okay. So, Disney might win the FOX battle but it will be a Pyrrhus victory as Disney had to put more than $19 BILLION more on the table to win the game ( and the battle may be has not ended yet ).

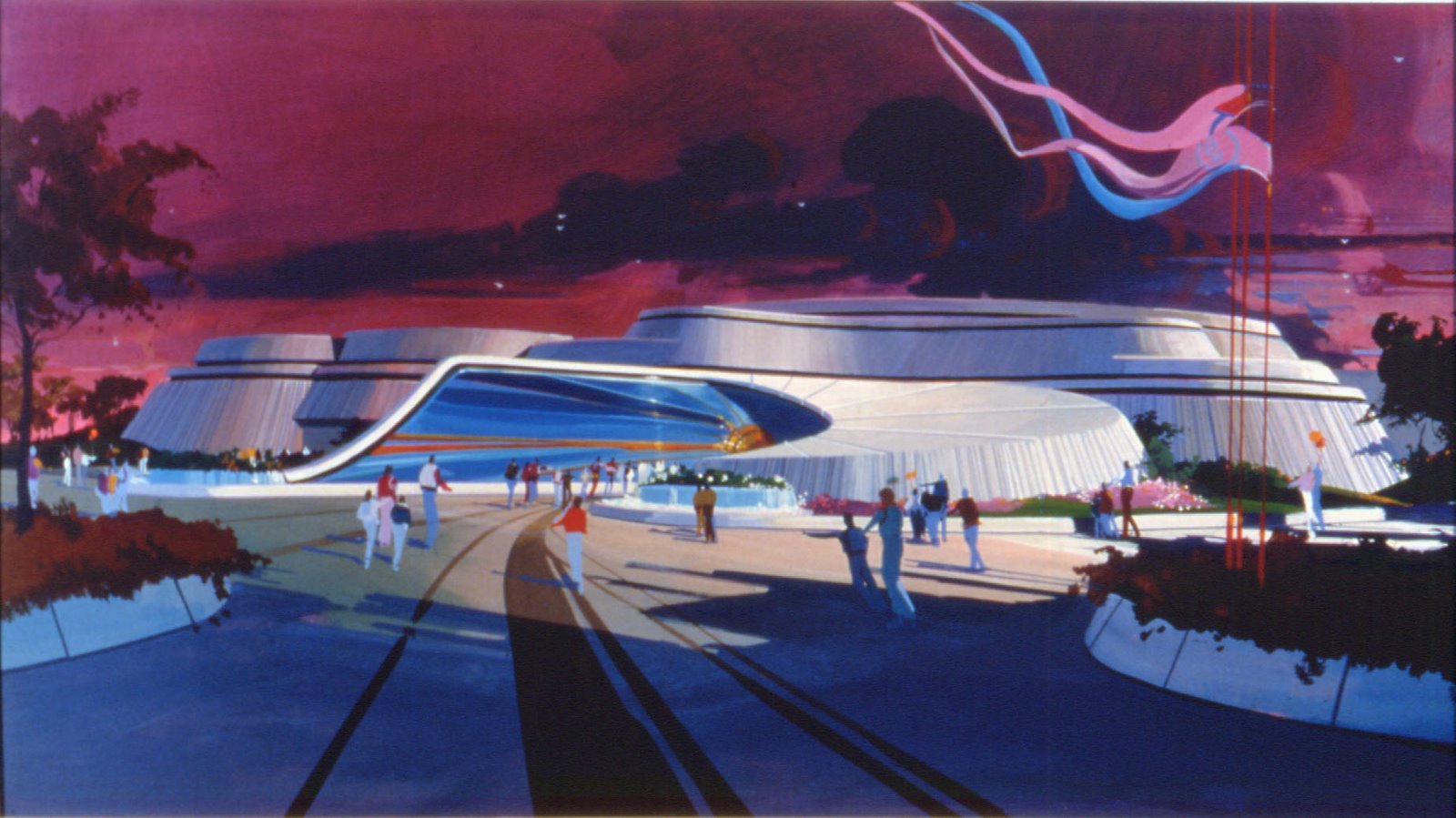

Now, THINK about it: for that SAME amount - of $19 Billion - Disney bought Pixar ( for $7.4 Billion ), LucasFilm ( for $4 Billion ), Marvel ( for $4 Billion ) AND built Shanghaî Disneyland ( park only ) for $3.6 Billion and made tons of money with each acquisition thanks to movies, merchandise, licenses, etc, not to mention SDL park and hotels revenues. For the same amount of $19 Billion Disney could have built at least FIVE new theme parks over the world or create at least FIFTY mini lands in its already existing parks with a $370 Million budget for each, and with E-tickets attractions in each lands.

Here, for the added $19 Billion Disney will have NOTHING more additional than it already had with its first $52 Billion offer. Comcast may lose the battle but Brian Roberts will have his revenge to his 2004 declined offer on Disney and for sure a big big laugh. And specially considering that Comcast owns Universal Studios and that all these $19 Billion that Disney had to add - and in cash! - will certainly have an impact on Disney parks future attraction budgets while Universal who will have spent not-one-cent in the operation will be free to spend tons of money on new rides and parks!

Above, an interesting infographic posted by Recode about the Media landscape which might help to understand the Disney Comcast bidding war going on for FOX.

Infographic: copyright Recode

3 comments:

the first deal did not include Sky network and other cable that Disney has promised to keep in Europe for 15 years

Bob Iger has been very good with mergers and acquisitions. Yes, Brian Roberts has been very savvy with Comcast's growth and acquisitions (NBC/Universal, Dreamworks), but there's a reason Fox is selling itself. If you can't beat them, you have to join them. If Disney doesn't get bigger, it will not have the resources to fend off a future takeover - by Google, Amazon, Apple, Facebook, Verizon, or even Netflix. I think it's too early to say it's a Pyrrhic victory.

Disney can still realize a lot of value and growth:

-- Overseas (Sky in UK, Star in India)

-- Domestic (Fox Studios, regional sports networks, Fox Searchlight)

-- Distribution (ESPN+, Disney"flix", Hulu)

-- Synergy (X-Men movies in the MCU could be $19 billion in the future)

Ultimately, the market is rewarding Netflix for subscriptions. If Disney can create competitors to Netflix for $10 or $20 per month, then the market will create tremendous value for shareholders.

The company needs to collect, mine, and leverage customer data. People who watch Star Wars movies on Disney"flix" could get prizes for attending Star Wars Films, gets special experiences for staying at Star Wars Hotels, gets loyalty points for spending more on shopDisney or Disney Store, gets early access to spend their money at runDisney Star Wars or Star Wars Land...

Disney already commands great customer loyalty. Like Apple's model where people choose to busy all Apple products (at a premium), Disney could build out its physical and digital eco-system so if people make a media purchase, it's owned by Disney.

In the meantime, I look forward to all the new theme parks additions around the world! First up, Pixar Pier in Anaheim... here we go!

Content is king right now

Post a Comment