Comcast Corp. has bowed out of its bidding war with Disney to acquire major 21st Century Fox assets, and instead focus on acquiring the European satellite TV provider Sky. Comcast’s move clears the way for Disney to take control of the Murdoch family’s Fox assets and intensify a looming battle with Netflix and other video-streamers for media-industry dominance.

“Comcast does not intend to pursue further the acquisition of the Twenty-First Century Fox assets and, instead, will focus on our recommended offer for Sky,” the company said in a statement Thursday.

Disney and 21st Century Fox have agreed to a $71.3 billion deal that will see Disney take control of the bulk of Fox’s assets, including the 20th Century Fox film and TV studio, FX Networks, National Geographic Partners, and Fox’s 30% stake in Hulu. Comcast and Fox, and by association Disney, are still competing to buy London-based Sky, in which 21st Century Fox has a 39% stake.

“Our incredible enthusiasm for this acquisition and the value it will create has continued to grow as we’ve come to know 21st Century Fox’s stellar array of talent and assets.” said Disney chairman-CEO Bob Iger. “We’re extremely pleased with today’s news, and our focus now is on completing the regulatory process and ultimately moving toward integrating our businesses.”

Comcast’s challenge to Disney over the 21st Century Fox deal marked the most high-profile M&A contest in media in 25 years, since Sumner Redstone and Barry Diller went to war over Paramount Pictures. Comcast’s decision to back down from Fox came after institutional investors and bondholders expressed concern about the debt load the cable giant would pile up to pursue an all-cash offer significantly higher than the $65 billion bid it fielded on June 13. The government’s decision to appeal the court decision in the AT&T-Time Warner anti-trust trial that allowed those companies to merge was also a factor in Comcast’s decision to give up the chase on Fox. “I’d like to congratulate Bob Iger and the team at Disney and commend the Murdoch family and Fox for creating such a desirable and respected company,” Comcast chairman-CEO Brian Roberts said in a statement Thursday.

Read the full Variety article HERE.

Although the battle for Fox is over, the one for SKY is not and Comcast will concentrate its forces on this one. In the meantime Comcast CEO Brian Roberts has succeeded to make Disney overpay its purchase of Fox with $19 Billion more than Disney first offer of $52 Billion. If $19 Billion don't say anything to you, for this amount Disney bought Pixar ( for $7.4 Billion ), LucasFilm ( for $4 Billion ), Marvel ( for $4 Billion ) AND built Shanghaî Disneyland ( park only ) for $3.6 Billion and made tons of money with each acquisition thanks to movies, merchandise, licenses, etc, not to mention SDL park and hotels revenues. Here, for the added $19 Billion Disney will have NOTHING more than it already had with its first $52 Billion offer.

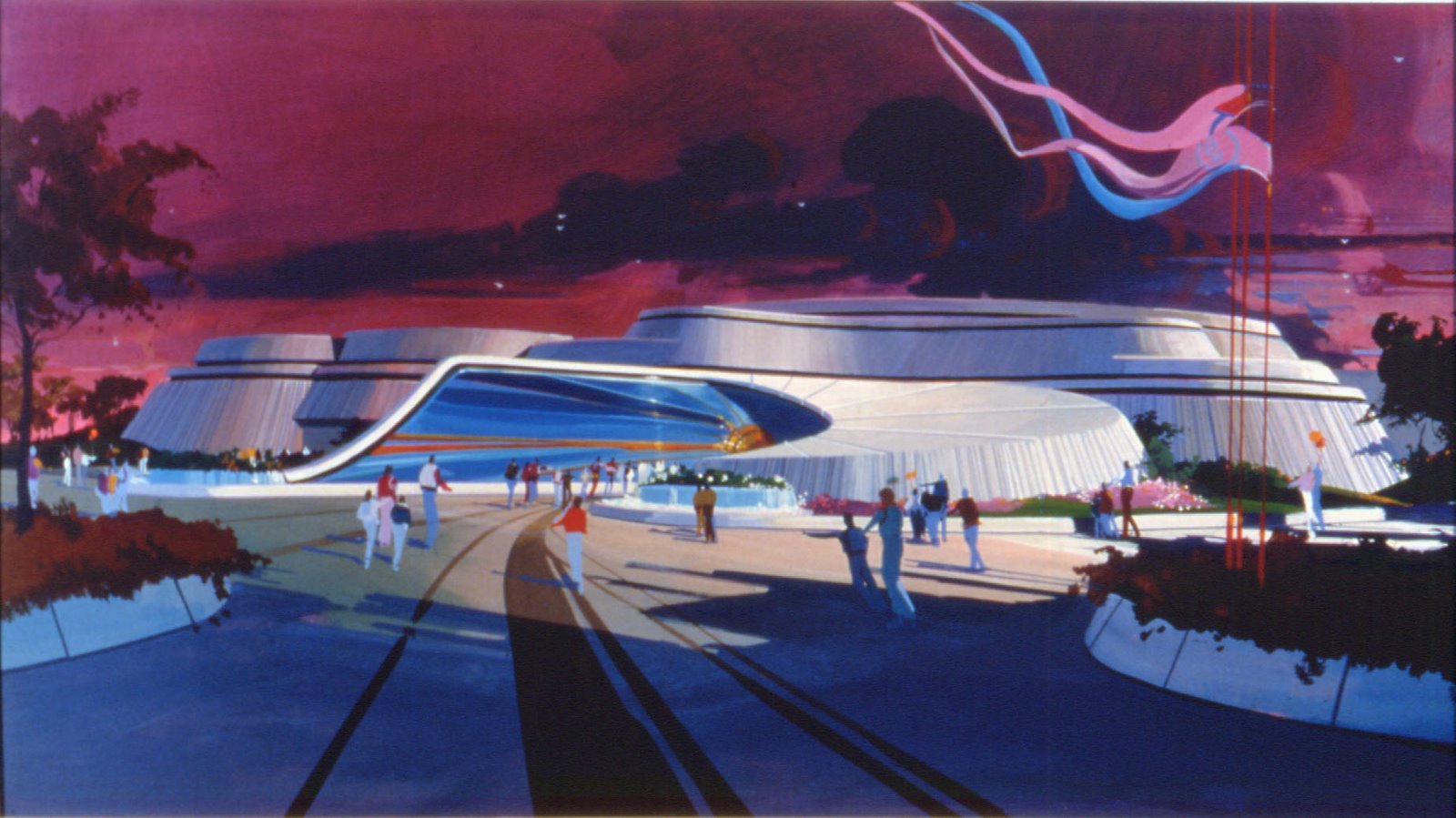

For the same amount of $19 Billion Disney could have built at least FIVE new theme parks over the world or create at least FIFTY mini lands in its already existing parks with a $370 Million budget for each, and with E-tickets attractions in each lands. Will this mountain of dollars spent to own Fox have an effect on Disney theme parks future expansions with projects cancelled or more limited budget for new attractions? That is something that we should know in a very near future, and that's probably also the hope of Brian Roberts, as i remind you that Comcast owns Universal Studios, Disney theme parks biggest competitor.

No comments:

Post a Comment